Watch this video explaining;

- Present Value

- Future Value

- Net Present Value (NPV)

- Return on Investment (ROI)

- Payback period

- Time value of money

- Cashflow analysis

- Present Value

- Future Value

- Net Present Value (NPV)

- Benefit Cost Ratio (BCR)

- Cost Benefit Analysis

- Payback Period

- Internal Rate of Return (IRR)

- Opportunity Cost

- Sunk Cost

Time value of money

The time value of money (TVM) is a financial concept that recognizes the potential earning capacity of money over time due to its ability to earn interest or generate returns. In essence, it acknowledges that a dollar today is worth more than a dollar in the future, because money can be invested and earn a return over time.

There are two main principles underlying the time value of money:

- Future Value: This principle calculates the value of money in the future, given a certain interest rate or rate of return. It answers the question: “How much will a sum of money grow to, after earning interest or returns over a specified period?”

- Present Value: This principle calculates the current value of a future sum of money, discounted by a certain interest rate or rate of return. It answers the question: “What is the current value of a future sum of money, taking into account its potential to earn interest or returns?”

The time value of money is important in various financial decisions, including:

- Investment Analysis: Determining the potential returns of different investment opportunities by calculating future values and present values of cash flows.

- Capital Budgeting: Evaluating the profitability of long-term investment projects by discounting future cash flows to their present value.

- Loan Amortization: Calculating loan payments and understanding the cost of borrowing money by considering interest rates and repayment schedules.

- Retirement Planning: Estimating the amount of money needed for retirement by accounting for inflation and investment returns over time.

The time value of money is a fundamental concept in finance and plays a crucial role in financial planning and decision-making. It allows individuals and businesses to make informed choices about investments, savings, borrowing, and other financial activities by considering the potential growth or decline of money over time.

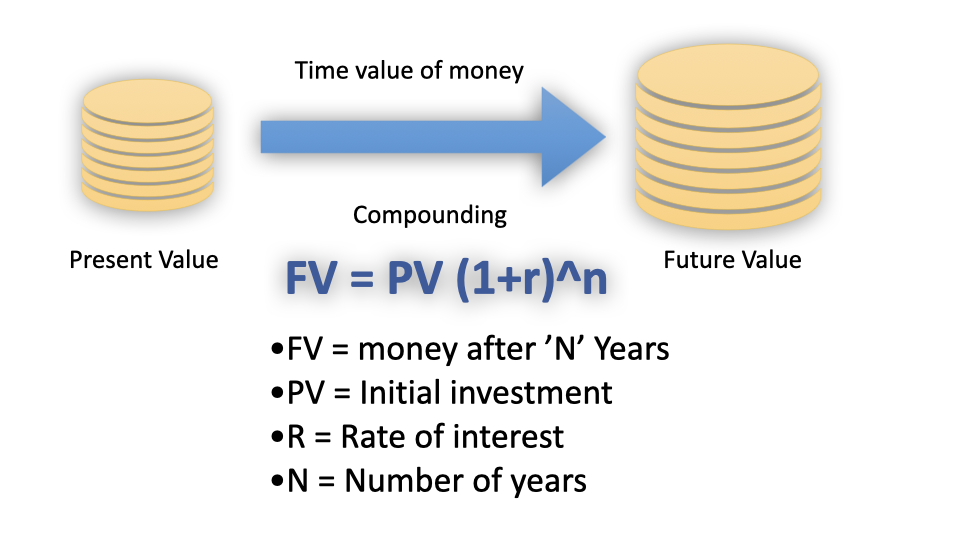

Future value of money

- Whatever we can buy today with ‘X’ amount, we will not be able to buy after five years

- The buying power of money decreases over a period of time due to factors like inflation

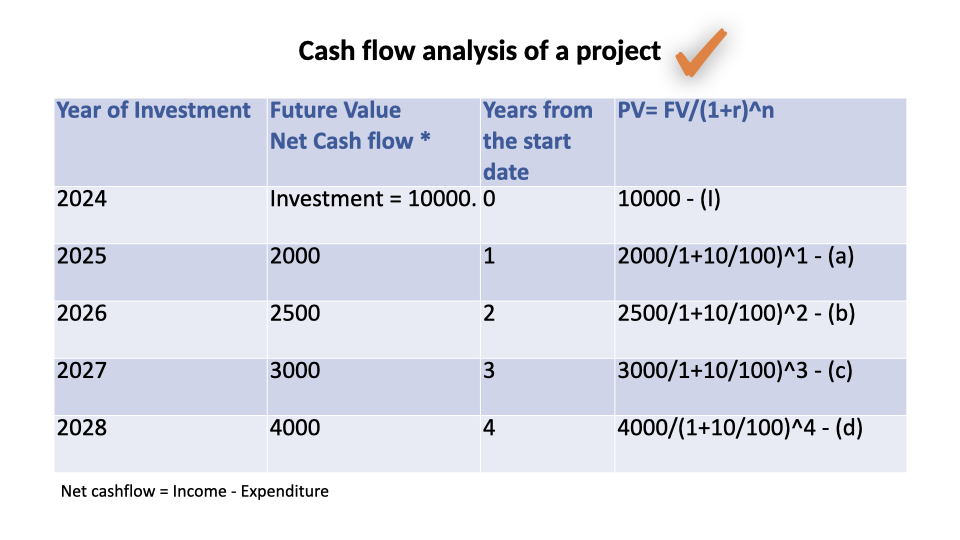

- In projects, we make an investment of ‘X’ today inorder to get the benefits ‘Y’ in the future

- The money we are investing today is in Present Value (Pv) and the benefits we accrue in the future are in Future Value (Fv) terms.

- Since the value of money varies over a period of time, we cannot compare present value with future value

- The process of investing money and the interest gained on the investment over a period of time is known as compounding

- Fv=Pv(1+r)^n where;

- Pv = Present Value

- Fv = Future Value

- r = rate of interest

- n= number of years

An example

- Amount deposited for a period of 5 years (Pv) = 1000

- Rate of interest (r) = 8%

- Future value after 5 years = Pv(1+r)^n

- 1000 (1+8/100)^5

- 1000(1.08)^5 = 1000*1.46=1469

A future value of 1469 which we will get after 5 years is equivalent to 1000 as of today

Hence, before comparing the cost and benefits, everything must be either converted to present value or to the future value.

If we invest 1000 in bank for a period of 5 years at a bank interest rate of 8% and invest the interest also into the bank (componding), then we will get 1469 after 5 years. So, If we are investing 1000 in a project, the returns from the project must be more than 1469, else it is better to invest the money in the bank than doing the project.

Project selection ratios

Project selection ratios are metrics or criteria used by organizations to evaluate and prioritize potential projects for execution. These ratios help ensure that projects align with the organization’s strategic objectives, maximize return on investment, and utilize resources effectively. While specific ratios may vary depending on the organization’s industry, goals, and preferences, here are some common project selection ratios:

- Return on Investment (ROI): This ratio compares the expected financial return from a project to the investment required to execute it. Projects with higher ROI ratios are typically prioritized as they offer greater value for the resources invested.

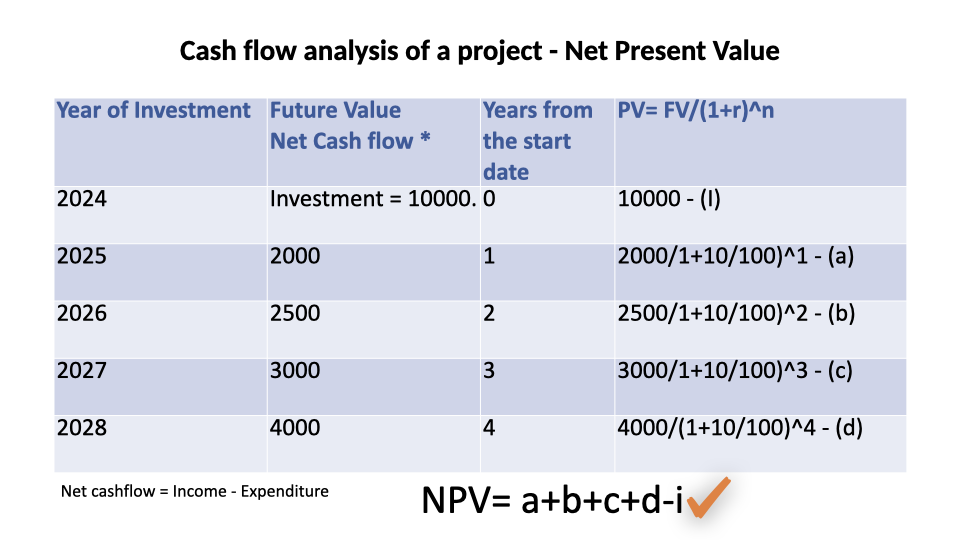

- Net Present Value (NPV): NPV calculates the present value of future cash flows generated by a project, taking into account the time value of money and the project’s initial investment. Projects with positive NPV are considered favorable as they are expected to increase the organization’s overall value.

- Internal Rate of Return (IRR): IRR represents the discount rate at which the net present value of a project’s cash flows equals zero. Projects with higher IRRs are preferred as they offer higher rates of return on investment.

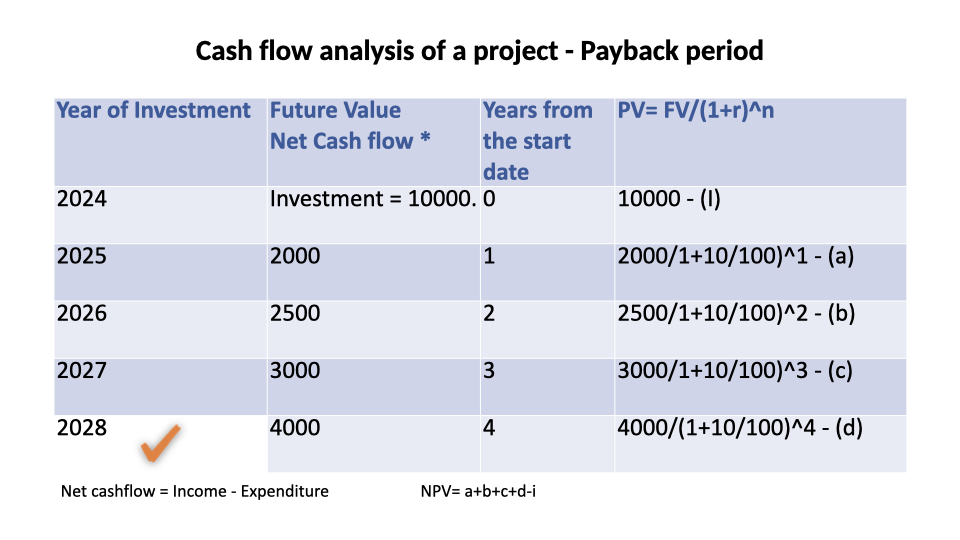

- Payback Period: Payback period measures the time it takes for a project to recoup its initial investment through generated cash flows. Shorter payback periods indicate quicker returns on investment and are often favored by organizations.

- Benefit-Cost Ratio (BCR): BCR compares the present value of a project’s benefits to its costs. A ratio greater than 1 indicates that the benefits outweigh the costs, making the project economically viable.

These project selection ratios help organizations make informed decisions about which projects to pursue, ensuring that resources are allocated to projects that offer the greatest value and strategic alignment.

Opportunity cost

Opportunity cost refers to the value of the next best alternative foregone when a decision is made to allocate resources (such as time, money, or effort) towards one option rather than another. In other words, it represents the benefits that could have been gained by choosing the next best alternative.

Here’s a simplified explanation:

Imagine you have a free afternoon and two options: Option A is to study for an upcoming exam, and Option B is to go to the movies with friends. If you choose Option A (studying), the opportunity cost is the enjoyment and social interaction you would have gained from going to the movies with friends. Conversely, if you choose Option B (going to the movies), the opportunity cost is the knowledge and preparation you would have gained from studying.

In a business context, opportunity cost is a critical concept in decision-making, particularly in resource allocation and investment decisions. For example, if a company decides to invest in Project X, the opportunity cost is the potential return or benefits it could have gained by investing in Project Y or another investment opportunity instead.

Understanding opportunity cost helps individuals and organizations make more informed decisions by considering not only the benefits of their chosen option but also the trade-offs and forgone opportunities associated with it. By evaluating opportunity costs, decision-makers can prioritize resources more effectively and maximize their overall value.

Sunk Cost

Sunk cost refers to a cost that has already been incurred and cannot be recovered, regardless of any future actions or decisions. In other words, a sunk cost is money, time, or resources that have already been spent and cannot be recovered or refunded.

Here’s a simple example to illustrate sunk costs:

Imagine you purchase a ticket to a concert for $100. However, on the day of the concert, you feel unwell and decide not to attend. The $100 you spent on the ticket is a sunk cost because it has already been paid and cannot be recovered, regardless of whether you attend the concert or not. Your decision whether to go to the concert should be based on factors like your health and enjoyment, not on the sunk cost of the ticket.

In business, sunk costs are common in projects or investments. For instance, if a company invests $1 million in developing a new product, and later realizes that the market demand is low, the $1 million spent on development is a sunk cost. Continuing to invest more money in the project to try to recoup the initial investment would not change the fact that the $1 million is already spent and cannot be recovered.

Understanding sunk costs is crucial in decision-making because it helps avoid the fallacy of “throwing good money after bad.” Decision-makers should focus on future costs and benefits when evaluating options, rather than being influenced by past investments that cannot be recovered. By recognizing sunk costs and disregarding them in decision-making, individuals and organizations can make more rational and effective choices.

Another recent example of sunk cost is the apple car project